The Federal Tax Authority published criteria detailing the process for determining how a person can claim tax residency in the UAE. In the past, there was no such test, and a person was reliant on the so-called 183-day rule.

The published criteria for tax residency in the UAE apply to natural persons. For corporates, tax residency is determined based on the concepts of the place of incorporation, place of effective management as well as the application of double taxation agreements.

Requirements for determining tax residency for natural persons

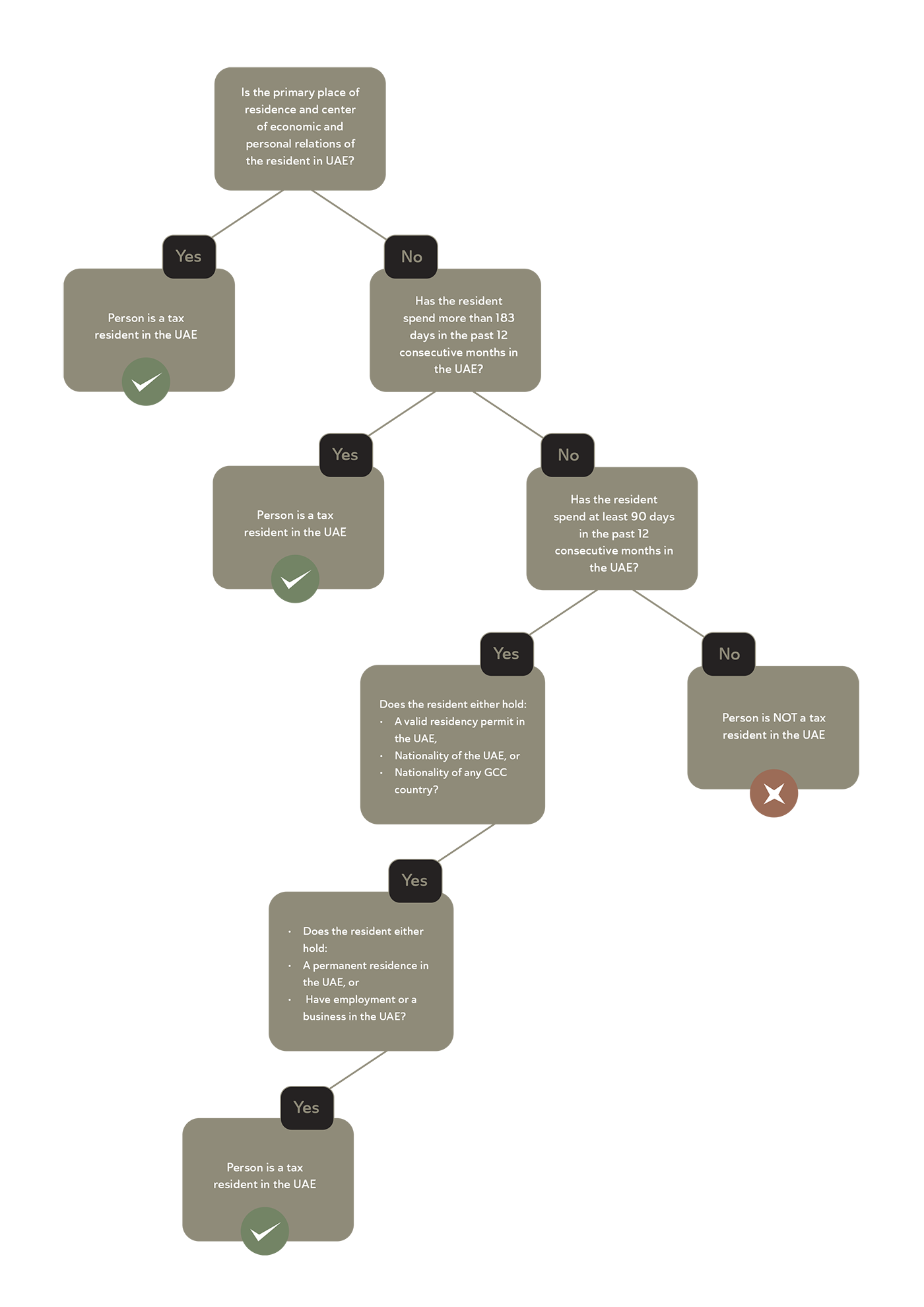

Tax residency for natural persons in the UAE requires first to determine whether the person’s primary residence and centre of economic and personal relations are in the UAE. If the answer is yes, then the person is a tax resident of the UAE.

If the answer is no, one must determine whether the resident has spent at least 183 days in the past 12 consecutive months in the UAE. If yes, then the person will be considered a tax resident of the UAE.

If the answer to the second criterion is also no, one must consider whether the resident has spent at least 90 days in the past 12 consecutive months in the UAE. If the answer is yes, one must further assess whether the person either has a valid residence permit for the UAE, is a UAE national, or is a national of any other GCC country. If the answer is yes, then one must determine whether this person has permanent residence in the UAE or has employment or a business in the UAE. If all these conditions are met, then the person will be considered a tax resident of the UAE.

If neither of these conditions is met, then the person will not be considered a tax resident of the UAE.

From the above, it is thus clear that at a bare minimum, to be a tax resident of the UAE, a person must spend at least 90 days in the past 12 consecutive months in the UAE.

What is the effect of claiming tax residency in the UAE?

Now, without a doubt, you can obtain a tax residency certificate and proof that you are a tax resident of Dubai. In the case of a company, a tax residency certificate is to be issued since it has been incorporated in the UAE.

One final consideration for an individual is that tax residency in the UAE does not necessarily result in the person being a tax resident only in the UAE. One also must consider your home country’s tax requirements and whether they will still tax you as a tax resident.